April 15, 2026, is the last day for residents and nonresidents who earned U.S. income to file federal tax returns for the 2025 tax year.

Generally, most international students and scholars who are on F, J, M, or Q visas are considered nonresidents for tax purposes. International students on J-1 and F-1 visas are automatically considered nonresident for their first five calendar years in the U.S., while scholars/researchers on J visas are automatically considered nonresidents for two out of the last six calendar years in the U.S.

If you have been in the U.S. for longer than the five-year period (F-1 and J-1 students) or the two-year period (J-1 scholars/researchers), review the Substantial Presence Test. This "test" will confirm your tax residency. If you are a "U.S. resident" for tax purposes, you may use another software such as Turbo Tax to prepare your documents.

We have teamed up with Sprintax to provide you with an easy-to-use tax preparation software designed for filing federal taxes for nonresident students and scholars in the U.S. We provide this service free of charge to our international students. You are not required to use Sprintax — it is simply one method of preparing your taxes.

We (and all other college staff) are not qualified or allowed to provide individual tax advice.

- If you wish to use Sprintax, after you log in, you will be asked a series of questions about the time you have spent in the U.S. during recent years.

- Sprintax will then determine your tax status.

- If it determines that you are a “nonresident alien” (NR) for federal tax purposes, you can continue to use the software and respond to a series of guided questions. Sprintax will then complete and generate the tax forms you must send to the tax authorities.

However, if Sprintax determines that you are a resident alien for federal tax purposes, you won’t be able to continue using the software.

State Tax Return Information

Sprintax also offers to file your state tax return; however, this cost will be your responsibility. If you choose not to file your state tax return with Sprintax, you may use other methods. Again, the cost of these state tax filing options is your responsibility, regardless if you use Sprintax or not.

NRVTAP — NonResident Volunteer Tax Assistance Program

NRVTAP is a free resource for nonresidents working on their taxes.

Overview of Sprintax

To help you file this year, Concordia has secured access through Sprintax to provide free-of-charge tax software where you will find an online, extensive, searchable, content library and tax preparation software for understanding your nonresident alien tax obligations and completing the tax return.

Sprintax was used by more than 200,000 international students, scholars, and nonresidents last year, and the average federal refund received by eligible students was more than $900. Sprintax’s software will guide you through the tax preparation process, help you arrange the necessary documents, and check if you are due a tax refund.

Global Learning will provide you with an access code to use the software.

Sprintax Resources

For help, you also may access the Sprintax YouTube account where there are a number of educational videos on nonresident taxes. These will provide further clarity on nonresident tax and how to use Sprintax. Sprintax also offers a range of useful content on its blog to help you file your return.

Sprintax Free Educational Tax Webinars

Topics will include who must file, tax residency, FICA, state returns, implications of misfiling, as well as how to use Sprintax to prepare a compliant tax return.

Even if you do not actually use Sprintax to prepare your documents, this webinar can be very helpful to get familiar with US tax requirements. There are many options for webinars from now until April — we recommend every student attend one of these webinars.

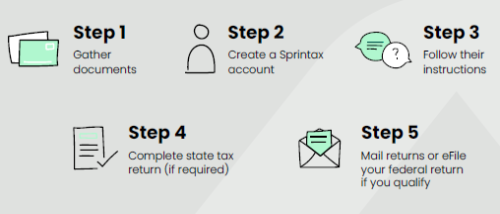

*Information about webinars is posted below in our Step-by-Step Guide for Using Sprintax.

Need More Sprintax Support?

If you need help while using Sprintax, you can contact their support team using the options below: